Is it Possible to Use Copy Trading in Your Forex Trading Journey?

Many people, especially forex trading enthusiasts, wonder whether they can make use of copy trading or not. If you have the same question in mind, continue reading this piece to learn about how copy trading can benefit you and help you spot potentially profitable forex or other trades with relative ease.

What Makes Copy Trading Stand Out?

One of the key aspects of copy trading is the ability to diversify your portfolio by connecting a portion of it to multiple traders. This helps to spread the risk and ensures that your portfolio is not overly exposed to the performance of any one trader.

It is important to note that a common recommendation for copy traders is to invest a moderate amount of your portfolio with one trader, rather than allocating all of your funds to one trader. This allows for a more balanced approach to investing and can lead to greater returns over time.

How to Find a Good Copy Trading Platform

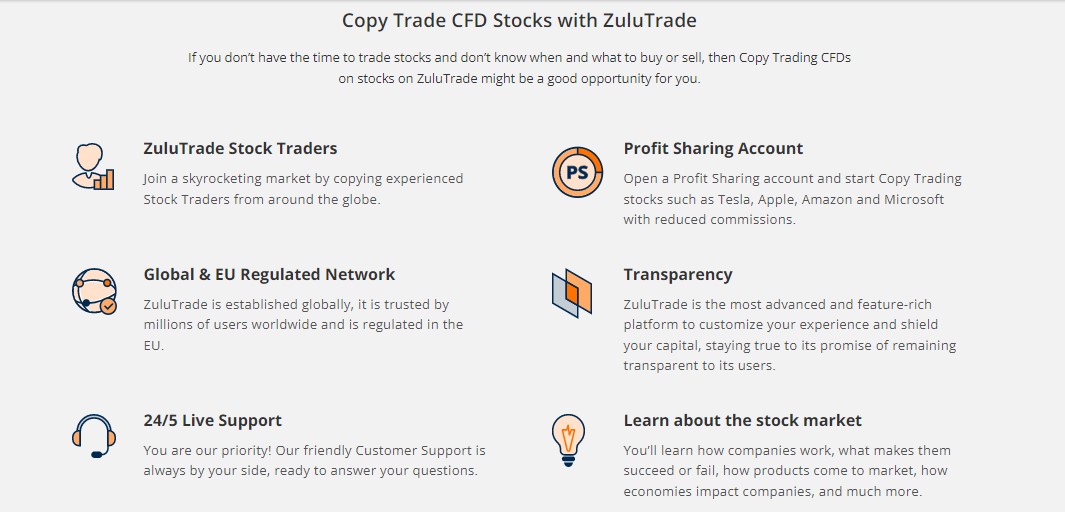

There are several ways to find a reliable copy trading platform like ZuluTrade that provide great forex trading services to you and they are as follows:

Research: Look for platforms that have been around for a while and have a reputation for being reliable. Read reviews from other traders and see what they have to say about the platform’s reliability.

Regulation: Search for platforms that are regulated by reputable financial authorities. These regulatory bodies have strict rules and oversight to ensure that the platform is operating in a fair and transparent manner.

Transparency: Look for platforms that provide transparent information about their traders, such as their trading history, risk management techniques, and performance metrics.

Security: Ensure that the platform you opt for is completely secure and provides high profile security for safeguarding your information.

Support: The platform you choose must have a dedicated customer support team available to assist you with any issues or questions that you may have.

Platform features: Make sure the copy trading platform offers features like stop loss, forex trading services and risk management tools that can help you to manage your investments better.

It’s also a good idea to test out a platform with a small amount of money before committing a larger amount of capital, so that you can get a sense of how the platform operates and whether it is a good fit for you.

Who is this form of Trading Suitable for?

Copy trading can be suitable for a variety of traders, including:

Beginner traders: Copy trading can be a good option for traders who are new to the market and want to learn from more experienced traders. By following a wide variety of successful traders, beginner traders can gain valuable insights into how the market works and develop their own trading strategies.

Time-constrained traders: Copy trading can be a good option for traders who have limited time to devote to trading. By looking at what other traders are doing, time-constrained traders can still participate in the market without having to devote a lot of time to research and analysis.

Investors: Copy trading can be a good option for investors who want to diversify their portfolio by following the trades of multiple traders, rather than investing in a single stock or asset.

Traders with limited knowledge: Copy trading can be a good option for traders who lack the knowledge or experience to make trades on their own. These traders can still participate in the market without having to acquire a deep understanding of the markets.

Traders who don’t want to be emotionally involved: Copy trading can be a good option for traders who don’t want to get emotionally involved in the market. By following what other traders are doing, you can avoid the stress and emotional rollercoaster of making your own trades.

It’s worth noting that copy trading is not suitable for everyone and it’s important to understand the associated risks and to carefully evaluate the performance of the traders you are considering to follow.